Need Financing For Your Dental Real Estate?

When it comes to acquiring Dental real estate, having the right financing options is crucial to ensure a smooth and successful transaction. Our Dental real estate brokerage specializes in providing comprehensive financing services tailored to meet the unique needs of healthcare providers and investors. Whether you are looking to purchase, refinance, or invest in Dental properties, our team of experts is here to guide you through every step of the financing process.

Why Choose Our Real Estate Financing Services?

Navigating the complexities of Dental real estate financing can be challenging. Our brokerage offers:

Expertise in Dental Properties: With extensive experience in the healthcare real estate market, we understand the specific requirements and regulations that apply to Dental properties.

Customized Financing Solutions: We work closely with you to develop financing strategies that align with your financial goals and practice needs.

Access to Multiple Lenders: Our established relationships with a wide range of lenders allow us to find the best financing options with competitive rates and terms.

Streamlined Process: We manage all aspects of the financing process, from initial consultation to closing, ensuring a seamless experience.

To get started, complete our Real Estate Consultation Form Here and one of our experienced practice transition advisors will contact you within 24 hours.

Have Questions?

Don't hesitate to contact myself or one of our Transition Advisors.

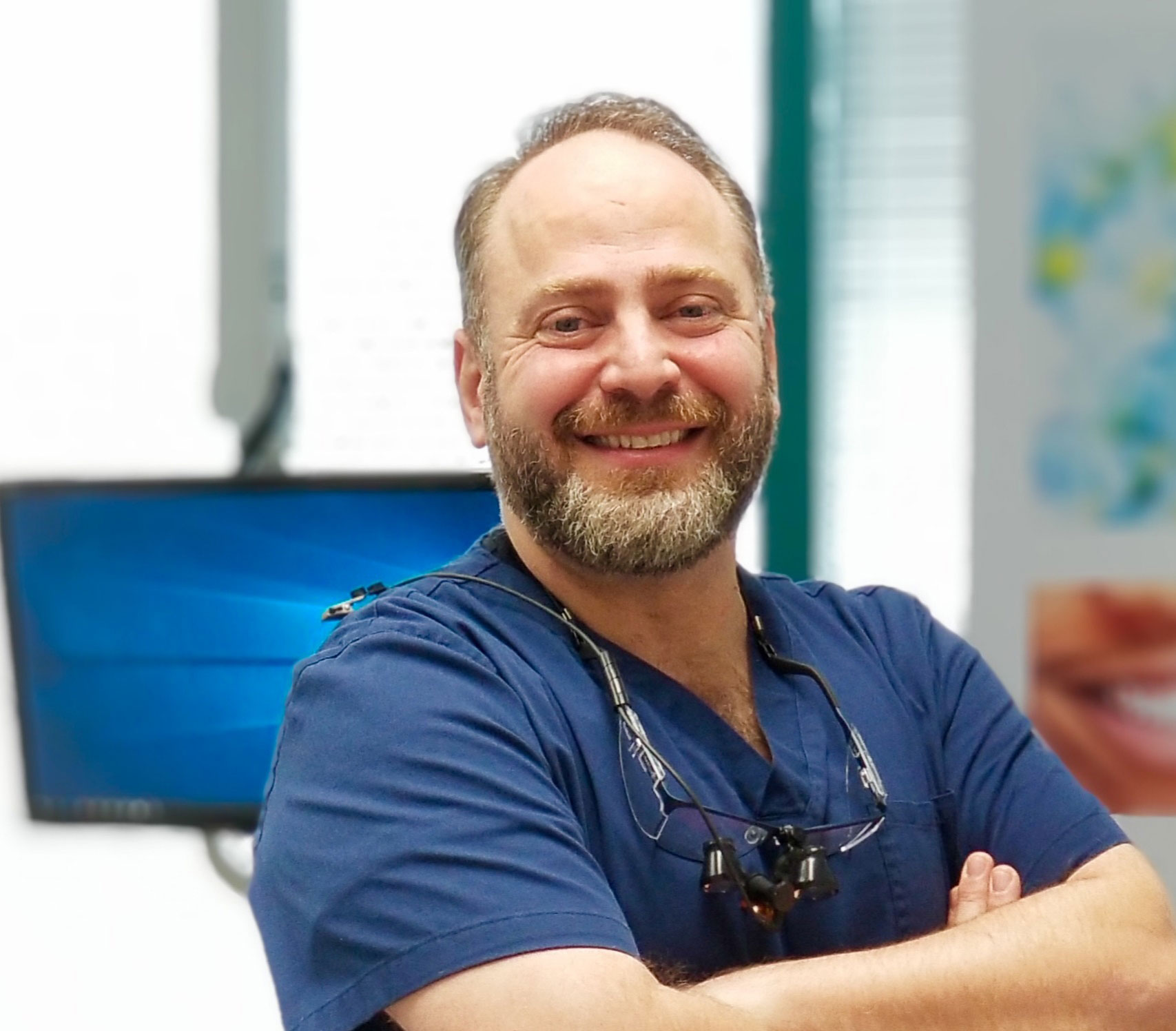

Michael S. Furlong

Senior Transitions Officer

(800) 815-0590

All Discussions Are 100% Confidential